Marvell Tech's AI Chip Boom & What's Next

Hey, so Marvell Tech, you know, the company with that stock ticker MRVL.O, they just dropped their forecast for the next few months, and get this, they think they'll make more money than everyone on Wall Street thought!

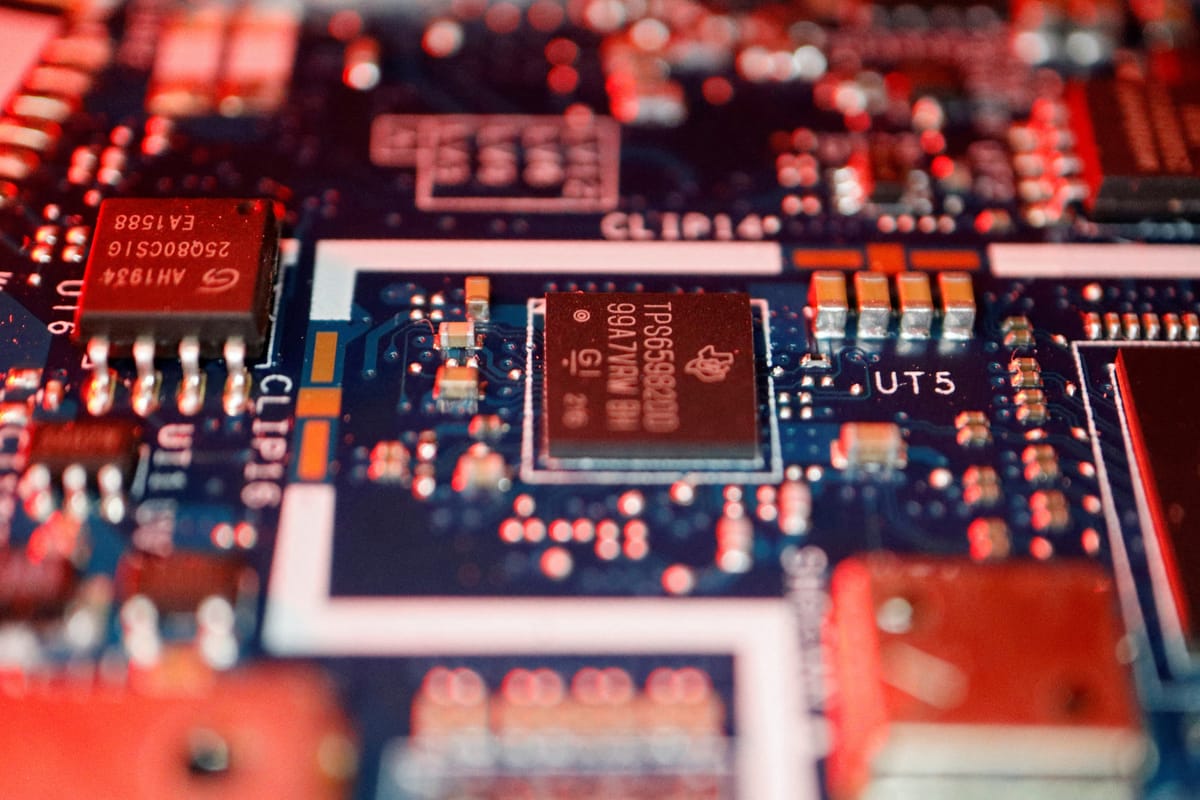

Why the good vibes? Well, it's all about those super-special chips they make for all that crazy AI stuff going on in data centers. People are apparently really needing their custom AI chips right now, and even their networking chips and the ones that handle light signals are getting lots of orders. This is a big deal for those huge companies trying to build up their systems to handle all the AI work.

Marvell even said after they shared their earnings report that they expect this whole AI trend to keep going strong. They see the big companies spending a lot, new government-backed data center projects popping up, and even new players in other countries expanding the market.

Their data center part of the business, which is like, 76% of everything they do, brought in a whopping $1.44 billion in the first few months of the year. Also, their parts that deal with phone carriers and businesses seem to be getting better after a period where folks had too much stock.

Someone named Angelo Zino, an analyst over at CFRA Research, thinks these custom chips are gonna be the main thing driving their growth for the next maybe 3 to 5 years. He figures they'll actually help with profits, even if the chip margins aren't as high. He also mentioned that a webinar about their custom chips on June 17th could be pretty cool, maybe showing off more opportunities and even some new customers for 2026.

But, you know, it's not all sunshine and rainbows. Their consumer business, like for gaming, was a bit weak. Revenue went down 29% from the last period, which they said was just because of the time of year for gaming. And their industrial section had a tough time too, with revenue falling 12%.

After all this news, their stock went down a little, about 2%, after the regular trading hours were over. They're predicting about $2 billion in revenue for the next quarter, give or take 5%. Analysts were thinking it would be around $1.98 billion, as per the data Reuters looked at.

Oh, and back in May, they actually pushed back their investor day conference. They said it was because the economy was a bit all over the place. Before that, they reported about $1.9 billion in revenue for the quarter that ended on May 3rd, which was a bit more than analysts expected at $1.88 billion. So, yeah, kind of a mixed bag of news, right?